Savings and investment options

Choosing your investment option

We know everyone’s approach to choosing investments may not be the same. Your investment decisions can differ from other program savers or throughout your lifetime based on your unique circumstances, financial constraints, timelines, and overall savings goals. Some examples of investment goals and selections are listed below.*

Goal: Save money for the long term

Investment option: You might consider any of the available options

Why: There are portfolios designed for a variety of goals and risk tolerance levels

Goal: Use funds to pay for qualified expenses throughout the year

Investment option: FDIC-Insured Portfolio

Why: This option is like cash and limits worry about short-term market changes when making frequent withdrawals

Goal: Saving for both long-term and paying for qualified expenses

Investment option: Spread savings among several portfolios

Why: Account owners can select how much money they contribute to each portfolio, making sure there are enough funds available for frequent withdrawals as well as put toward achieving your future savings goals

You may change the way in which future contributions are invested at any time. However, you may only change your investment choices twice per calendar year once the money is in your account.

Please note: Before investing, carefully consider the Plan's investment objectives, risks, fees, and expenses. This information and more about the Plan may be found in the CalABLE Account Plan Disclosure Booklet, which should be read fully and carefully before investing. The investment option descriptions contained on this website are provided for informational purposes only and do not constitute financial, investment, or other advice. Beneficiaries or their Authorized Legal Representatives are solely responsible for deciding which investment options to use.

CalABLE offers a total of eight savings and investment options

| Percent Allocation of Investment Option | ||||||||

|---|---|---|---|---|---|---|---|---|

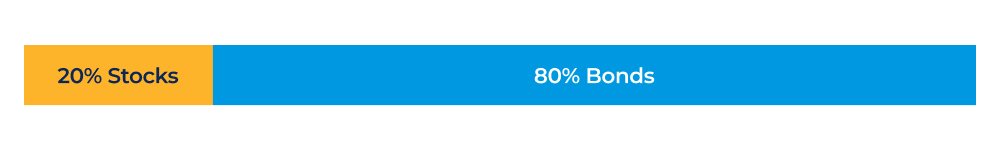

Income Portfolio |

Conservative Portfolio |

Income and Growth Portfolio |

Balanced Portfolio |

Conservative Growth Portfolio |

Moderate Growth Portfolio |

Growth Portfolio |

||

| Fund Name | Ticker | |||||||

| Fidelity® Total Market Index Fund | FSKAX | 0% | 13% | 26% | 33% | 39% | 52% | 65% |

| Fidelity® International Index Fund | FSPSX | 0% | 5% | 10% | 12% | 15% | 20% | 25% |

| Fidelity® Emerging Markets Index Fund | FPADX | 0% | 2% | 4% | 5% | 6% | 8% | 10% |

| Fidelity® U.S. Bond Index Fund | FXNAX | 60% | 60% | 50% | 42% | 34% | 17% | 0% |

| Fidelity® Long-Term Treasury Bond Index Fund | FNBGX | 5% | 5% | 4% | 4% | 4% | 3% | 0% |

| Schwab Treasury Inflation Protected Securities Index Fund | SWRSX | 3% | 3% | 2% | 2% | 2% | 0% | 0% |

| Vanguard Emerging Markets Bond Fund Admiral Shares | VEGBX | 6% | 6% | 2% | 1% | 0% | 0% | 0% |

| Vanguard High-Yield Corporate Fund Admiral Shares | VWEAX | 6% | 6% | 2% | 1% | 0% | 0% | 0% |

| Vanguard Cash Reserves Federal Money Market Fund Admiral Shares | VMRXX | 20% | 0% | 0% | 0% | 0% | 0% | 0% |

Fees and expenses

There’s a low annual fee of $30 for each CalABLE account to cover the program’s operating expenses. There are also low fees on the underlying mutual funds, which are part of each of the investment options, and a state administrative fee. These fees will generally total between 0.28% and 0.45% of the account’s balance per year. Additional fees are applied to your account if you opt out of electronic statements or request a withdrawal check, instead of doing everything online. You can learn more about the program fees in the Program Disclosure Booklet or our Fees FAQ.